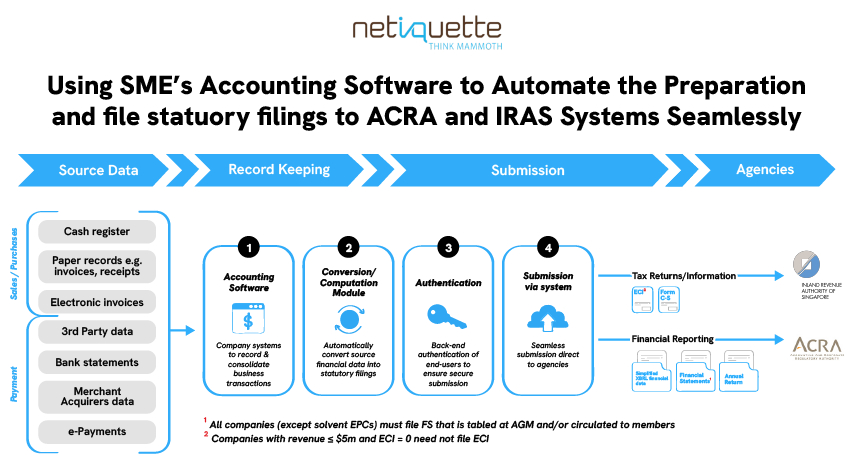

What is Seamless Filing?

To help SMEs stay competitive, ACRA and IRAS have partnered with software providers to create a system that automates tax and annual return filings with ACRA and IRAS to in line with the Smart Nation initiative.

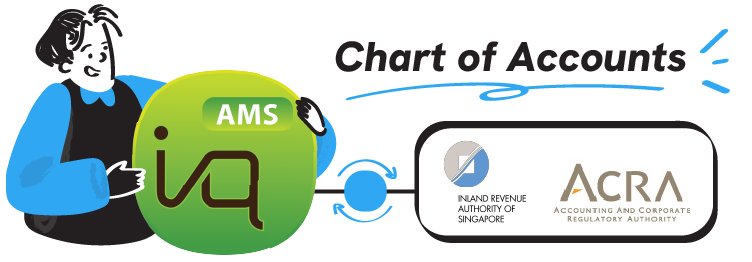

Seamless filing automates tax and annual return submissions within accounting software. It records transactions and generates statutory filings instantly. Linked to ACRA and IRAS via secure APIs, businesses can file directly without logging in to their portals.

More Details