What is Peppol InvoiceNow?

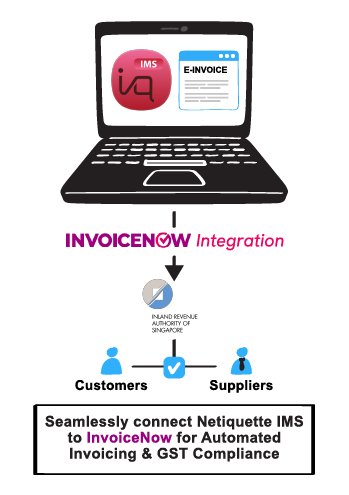

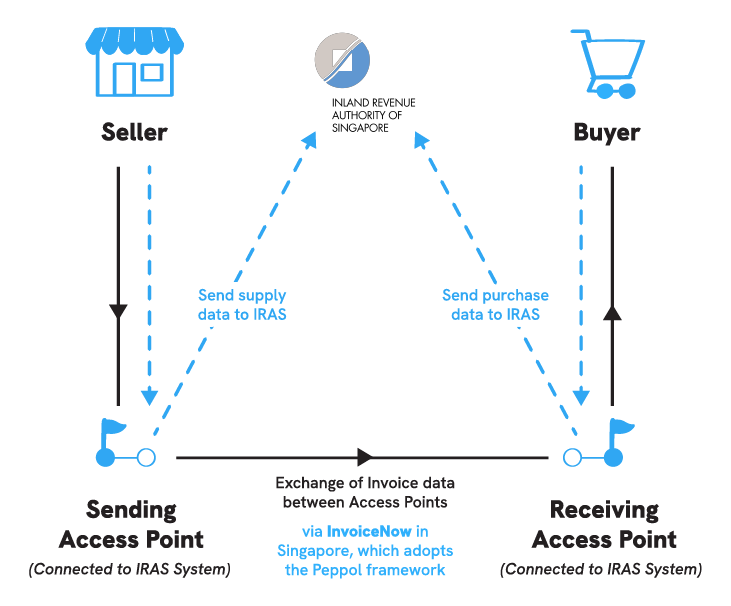

Peppol InvoiceNow is an initiative by IMDA that enables businesses to send and receive structured e-invoices through the Peppol network.

Benefits include:

- 📌 Faster invoice processing and payments.

- 📌 Improved accuracy with structured data format.

- 📌 Compliance with Singapore’s e-invoicing framework.

- 📌 Seamless integration with accounting and ERP systems.

- 📌 Easier tax filing – As invoices go through IRAS validation, businesses benefit from automated tax reporting and simplified compliance.